delayed draw term loan accounting

DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Another name for a Circle Up.

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics

The accounting implications differ depending on whether the borrowers or lenders accounting is being considered.

. 201 Delayed Draw Term Loans. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan. The amendment provides for among other things an increase to the existing term loan facility in the original principal amount of 400 million Incremental Term Loans and a new delayed draw term loan in the amount of 350 million which amount is available to be drawn up to 24 months from the date of the amendment.

The delayed draw term loan has. Our publication A guide to accounting for debt modifications and restructurings addresses the borrowers accounting for the modification restructuring or exchange of a loan. The Delayed Draw Loan if funded will bear interest at Borrowers option and subject to the provisions of the Term Loan Credit Agreement at Base Rate as defined in the Term Loan Credit Agreement or Eurodollar Rate as defined in the Term Loan Credit Agreement plus the Applicable Margin as defined in the Term Loan Credit Agreement for.

Commitment amount under a Revolver or to incur additional Term Loan debt under circumstances specified in the Credit Agreement. 6 to fund acquisitions. The lenders approve the term loans once with a maximum credit limit and charge variable interests on them.

DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional debt and thus the additional. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. With a DDTL you can withdraw funds several times from a predetermined loan amount.

DELAYED DRAW TERM LOAN AGREEMENT. Proceeds from the planned issuance along with a 350 million revolver draw and previously committed 11 billion delayed draw term loan will be used to fund a 22 billion distribution to. A Delayed Draw Term Facility intended to be used.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. A USD Tem Borrowing. The primary decision points considered by the.

This CLE course will discuss the terms and structuring of delayed draw term loans. And WACHOVIA BANK NATIONAL ASSOCIATION as Co. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified time period ie the reporting entity gets to choose the date that the debt funds within a.

The withdrawal periods are also determined in advance. May consist of immediately funded or delayed-draw term loans or of revolving credit commitments May be implemented as either a new credit facility or as an upsizing of an existing credit facility May be implemented via an amendment agreement an incremental assumption agreement or an amendment and restatement of the existing credit. The delayed draw term loan has a nominal ticking fee and the Company is not required to draw any amounts prior to June 30 2022.

The Accordion however is not pre-committed financing. When the delayed draw term loan is used to fully repay the converts the Company will not have any substantial maturities prior to February 2027 other than its asset-based revolving credit facility. The aggregate principal amount of all borrowings under the.

Definition of a Delayed Draw Term Loan. Writing in the Journal of Taxation of Financial Products New York partner Bora Bozkurt and colleagues from accounting firms EY and BDO explore. Subject to the terms and conditions set forth herein each USD Term Lender severally agrees to make a single loan to the Borrowers in Dollars on the Closing Date in an amount not to exceed such USD Term Lenders USD Term Commitment.

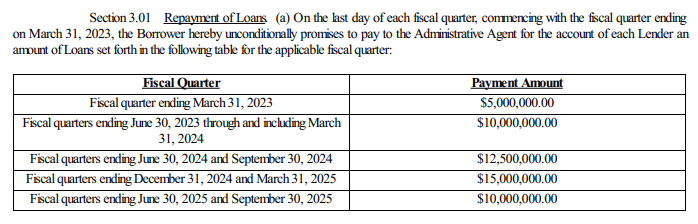

Conducted on Wednesday April 29 2020. Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions. The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first borrowing of Delayed Draw Term Loans on the last day of each March June September and December each in an amount equal to one and one-quarter percent 125 of the aggregate.

THIS DELAYED DRAW TERM LOAN AGREEMENT this Agreement is entered into as of May 5 2008 among PUBLIC SERVICE COMPANY OF NEW MEXICO a New Mexico corporation as Borrower the Lenders MORGAN STANLEY SENIOR FUNDING INC. 532 Accounting for Costs and Fees Incurred Before Debt Issuance 58 5321 General 58 5322 Nonrevolving Loan Commitment Fees 58 5323 Shelf Registration Costs and Fees 59 533 Accounting for Costs and Fees Upon Debt Issuance 59 5331 Debt Issuance Costs 59 5332 Fees and Other Amounts Paid to the Creditor 60. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and.

Create a 1250 million delayed draw term loan with enough capacity to repay all of the Companys outstanding convertible senior notes at maturity on July 1 2022. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. A transaction involving the issuance of a new term loan or debt security to one lender or investor and the concurrent satisfaction of an existing term loan or debt security to another unrelated lender or investor is always accounted for as an extinguishment of the existing debt and issuance of new debt.

Delayed Draw Term Loans if any in quarterly principal installments beginning the first fiscal quarter after March 21 2020 equal to the then-applicable Amortization Percentage of the aggregate principal amount of all Delayed Draw Term Loans made during the Delayed Draw Period. The revolving loans are approved for the short-term usually up to one year. ARTICLE II THE COMMITMENTS AND LOANS.

Delayed Draw Term Loan Availability Period means with respect to the Delayed Draw Term Loan Commitments the period from and including the first 1st Business Day immediately following the Closing Date to the earliest of a the Term Loan Maturity Date b twenty-four 24 months following the Closing Date and c the date of termination of the commitment of each.

Financing Fees Deferred Capitalized Amortized

Financing Fees Deferred Capitalized Amortized

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Balance Sheet Long Term Liabilities Accountingcoach

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

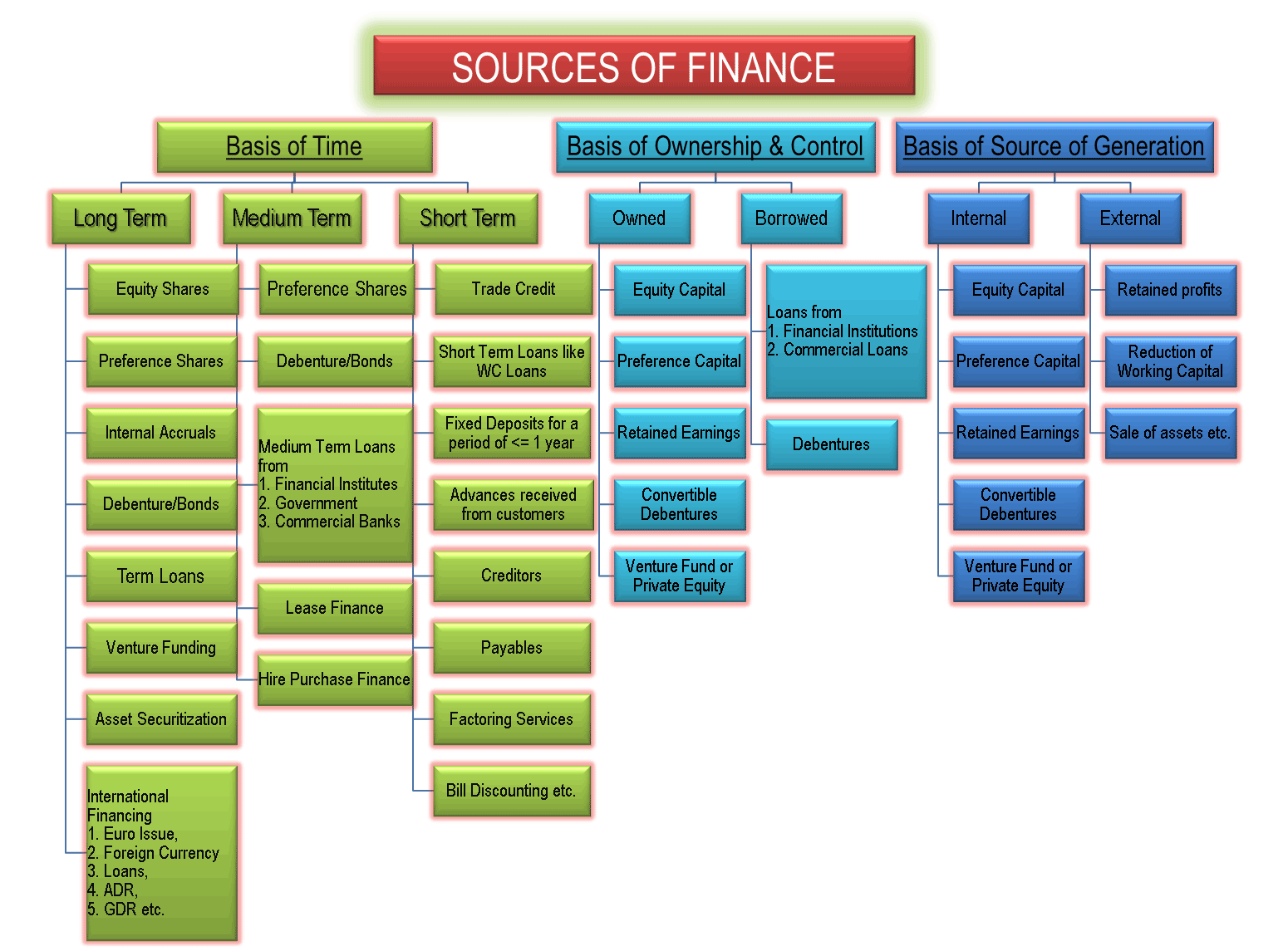

Sources Of Finance Owned Borrowed Long Short Term Internal External

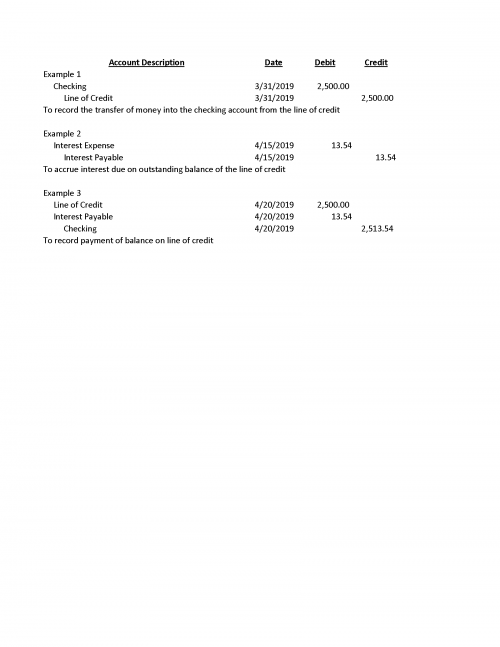

Line Of Credit Nonprofit Accounting Basics

Understanding The Construction Draw Schedule Propertymetrics

Andrew Lipman Director Corporate Banking Crossfirst Bank Linkedin

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Advice Finance Saving

7 3 Classification Of Preferred Stock

Covid 19 Impact And Recommendations For Credit Risk Management

Financing Fees Deferred Capitalized Amortized

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)